If it feels like something is off in America, there’s a good reason, according to Louis Navellier.

One key number in the American economy is completely out of whack.

And it could have dire consequences for your wealth.

“When you understand what this number means for America’s future, like I do, it will send chills down your spine,” Navellier said.

“In fact, it’s the main reason for dangerously high inflation.”

Navellier says there’s only one way to protect yourself.

And he explains everything in this video.

[Please note: The contents of this video will be very disturbing to some Americans.]

Who is Louis Navellier?

The son of a California stonemason, Louis gained a reputation as a child prodigy in math.

The son of a California stonemason, Louis gained a reputation as a child prodigy in math.

In college, he developed a mathematical formula to predict the stock market – and won a national contest against seasoned investors.

Since then he’s used his Navellier Formula to help him build a stock market empire.

Along the way, he’s made some big calls…

He predicted the Black Monday meltdown of 1987 a month early…

He warned the dot-com bubble was about to burst shortly before the market dropped 77%.

And his Navellier Formula helped him detect the market crash of 2008 months early as well.

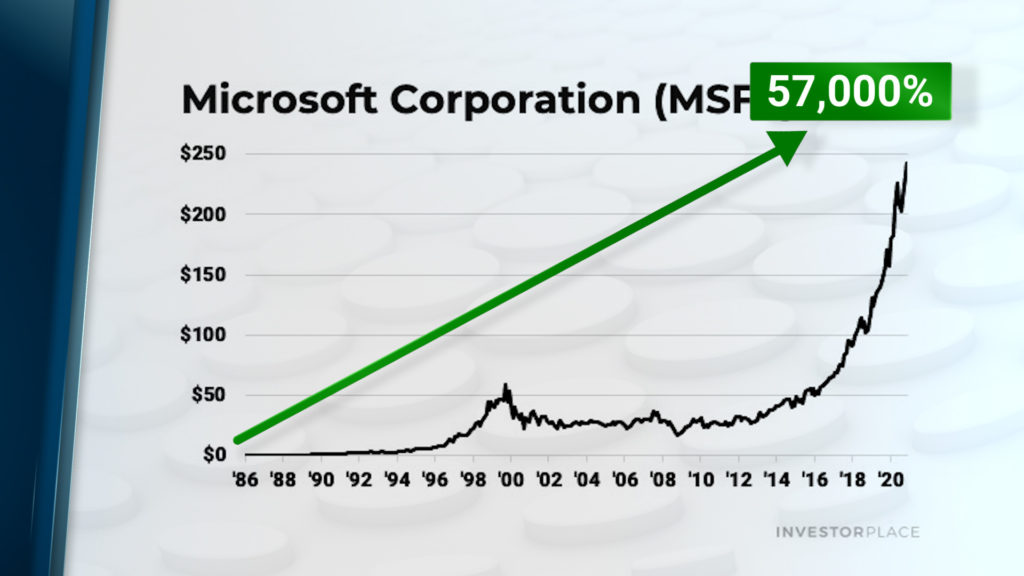

Louis picked Microsoft – at just 38 cents.

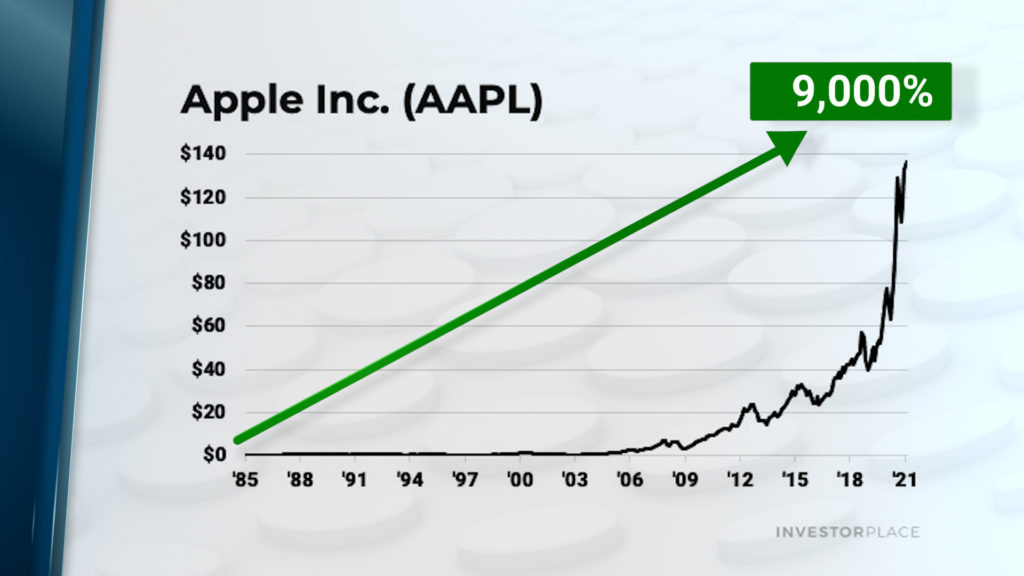

He spotted Apple at $1.49 and Oracle at 51 cents.

Now he says there’s only one thing you can do to protect your wealth from inflation.

About Growth Investor

In Growth Investor, we focus on today’s best mid- to large-cap stocks from a variety of sectors. The Buy List contains specific Buy Below prices and is always sorted into 3 categories of portfolio risk–Conservative, Moderately Aggressive or Aggressive–so you can buy according to your personal risk tolerance. Louis Navellier has been involved in the investing world for over 30 years. Since founding their research firm 45 years ago, their elite group has been responsible for accurately forecasting many of the world’s most innovative technological trends and breakthroughs long before they achieved mainstream acceptance.

*All investing includes risk of loss*