On Friday February 1st 2024, shares of Amazon spiked over 7% in a single day…and sent Amazon shares to all-time highs…

Thanks to massive investments into A.I. and machine learning back in 2014…

Amazon has now become one of the most efficient and profitable companies on earth.

It was this philosophy of spotting cutting edge technologies BEFORE competitors that’s taken Amazon from garage start-up in Bellevue Washington to the second largest company in the world…

And whether it was the internet in 1994…

Cloud computing in 2006…

Or Alexa and A.I. in 2014…

Jeff Bezos has built a $200 billion fortune out of spotting groundbreaking technology nobody else saw coming…

And on December 31st, 2021 — he’s done it again…

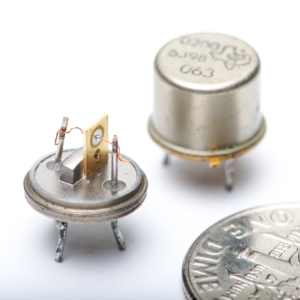

The technology looks like this…

And what it represents is the next level for humanity…

Bank of America said the technology would be,

“Bigger than fire and bigger than all the revolutions that humanity has seen”

And promises to disrupt markets worth over $46 trillion…

Every industry you can think of including…

• Pharmaceuticals $1.5 trillion

• Oil & Gas $5 trillion

• Telecom $1.8 trillion

• Farming $5 trillion

• Aerospace $103 billion

• Logistics $10.4 trillion

• Automotive $2.8 trillion

• Finance $25 trillion

Will all be rocked by this coming tech revolution…

And before you start guessing this has nothing to do with A.I. or ChatGPT…

Instead — it’s a foundational technology that’s to prove far more disruptive…

Already every tech company in the world is chasing after this technology including:

Google, IBM, Honeywell, Microsoft and Facebook…

What is this technology and why are these tech companies scrambling to control it?

Well one of the top tech investors of the last 40 years—a man who found Apple in 1988…IBM in 1992…Dell in 1997… Microsoft in 1988…Cisco in 1992… Oracle in 1988…and Amazon in 2003…Google in 2005…

Has put together a brand new presentation explaining the entire situation…

Click here now for the full story.

About

In Growth Investor, we focus on today’s best mid- to large-cap stocks from a variety of sectors. The Buy List contains specific Buy Below prices and is always sorted into 3 categories of portfolio risk–Conservative, Moderately Aggressive or Aggressive–so you can buy according to your personal risk tolerance. Louis Navellier has been involved in the investing world for over 30 years. Since founding their research firm 45 years ago, their elite group has been responsible for accurately forecasting many of the world’s most innovative technological trends and breakthroughs long before they achieved mainstream acceptance.

© 2024 InvestorPlace Media, LLC. rights reserved.

We respect your Privacy and value your Feedback

1125 N. Charles St, Baltimore, MD 21201