The AI giant is about to shock the world with a technology that could be even bigger than Artificial Intelligence.

Nvidia, the #1 company behind the AI boom is making a surprising move.

It’s now helping develop a new technology that could be 1,000 times more powerful than artificial intelligence. (click here to see this strange device)

According to Chris Royles, the Chief Technology Officer of the company Cloudera…

“This is set to overshadow AI as the next major technological revolution.”

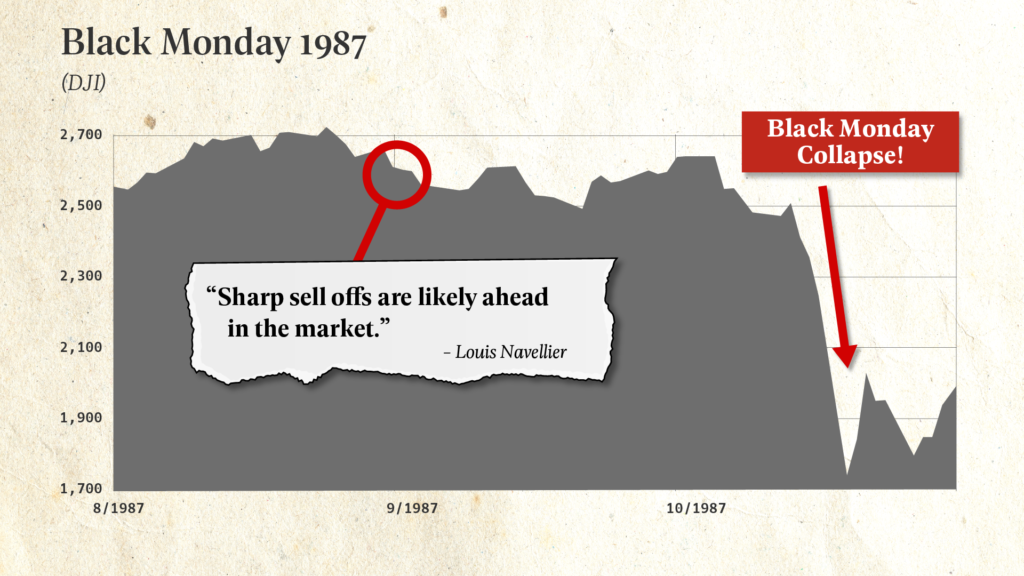

Louis Navellier, a legendary $790 million dollar money manager the New York Times called “An icon among growth investors…”

Is also predicting this will be the next big tech breakthrough.

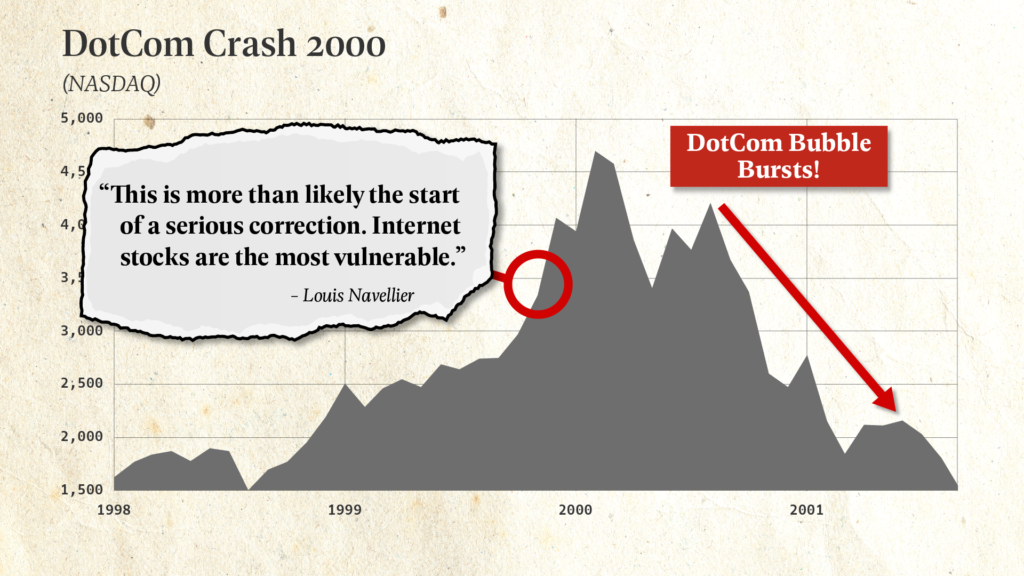

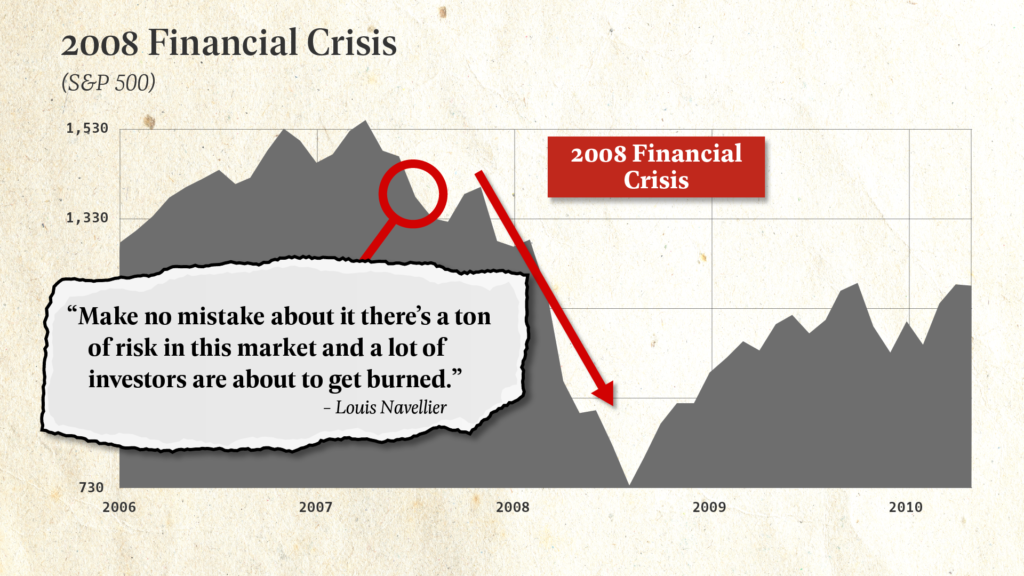

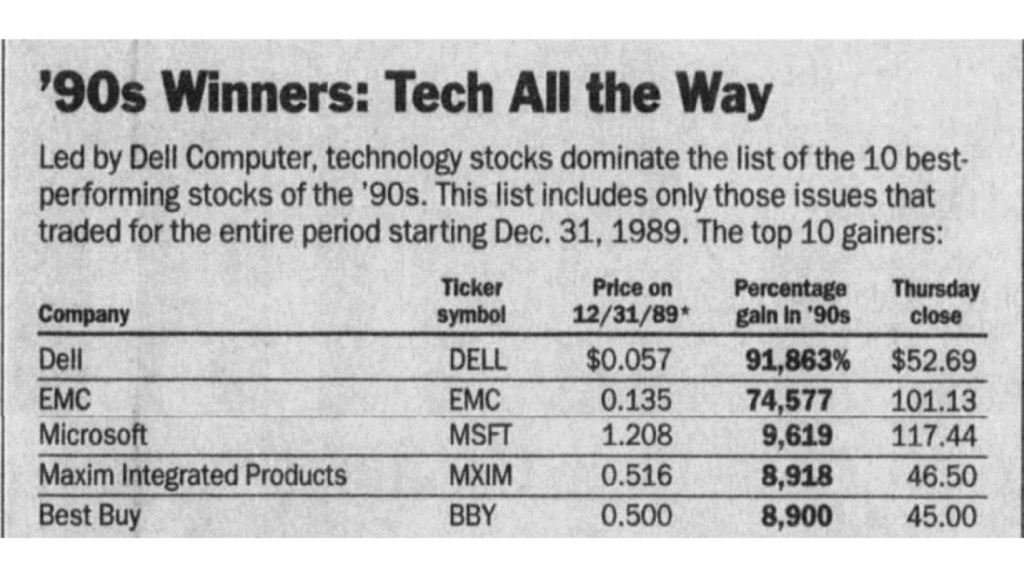

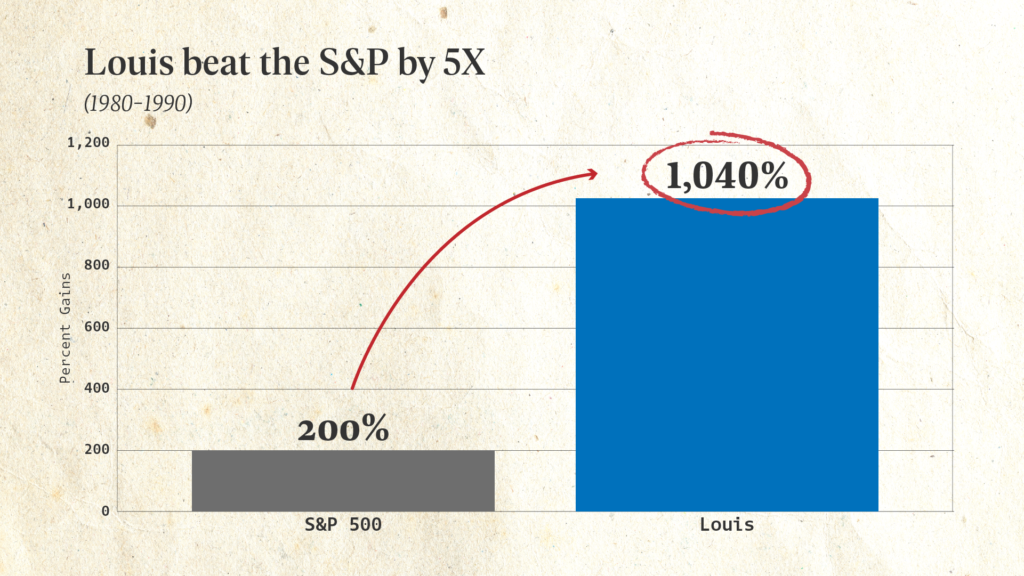

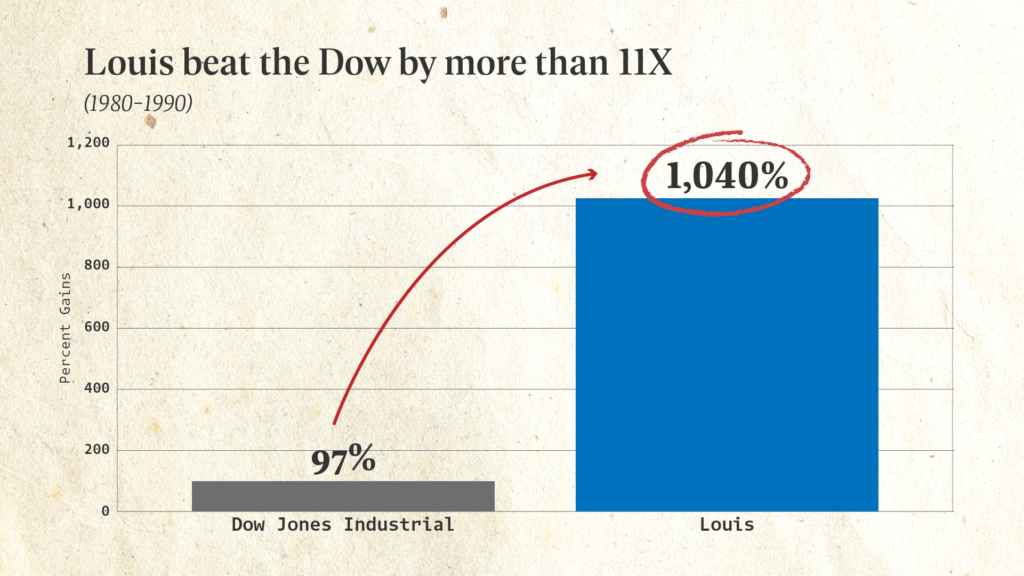

Mr. Navellier has been way ahead of the curve when it comes to this AI boom.

He picked Nvidia in 2016, before it jumped as high as 16,195%. But he’s now urging investors to make a new move.

“Nvidia is a remarkable company. But shares are not cheap anymore” says Mr. Navellier.

“While I’m telling my readers who bought shares of Nvidia to hold on to them, I believe the biggest gains will come from smaller companies that are helping Nvidia develop this new tech,” he says.

In less than a year, some of these stocks have jumped high enough to turn $10,000 into… $238,000… $290,000… and even $433,000.

Normally it would take decades for you to build that kind of wealth in the stock market.

Not even Nvidia has been able to deliver gains this big, this fast.

And Nvidia was the best-performing stock of the past decade.

The opportunity here is so explosive that Mr. Navellier just gave an interview where he revealed all the details on Nvidia’s new invention.

Click here to see the interview and get details on his top three stocks

Including Nvidia’s partner that he believes will be the leader in this space.

About

In Growth Investor, we focus on today’s best mid- to large-cap stocks from a variety of sectors. The Buy List contains specific Buy Below prices and is always sorted into 3 categories of portfolio risk–Conservative, Moderately Aggressive or Aggressive–so you can buy according to your personal risk tolerance. Louis Navellier has been involved in the investing world for over 30 years. Since founding their research firm 45 years ago, their elite group has been responsible for accurately forecasting many of the world’s most innovative technological trends and breakthroughs long before they achieved mainstream acceptance.

© 2025 InvestorPlace Media, LLC. rights reserved.

We respect your Privacy and value your Feedback

1125 N. Charles St, Baltimore, MD 21201

According to one of the world’s leading financial experts…

According to one of the world’s leading financial experts…