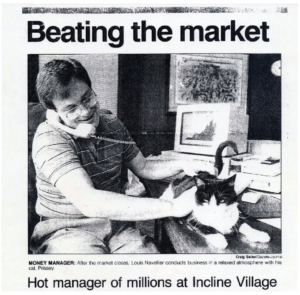

Forbes magazine called Louis Navellier the “King of Quants”…

Forbes magazine called Louis Navellier the “King of Quants”…

And for the past 40 years — his unique financial analysis has allowed him to spot the world’s fastest growing companies… years in advance.

He found Apple in 1988… IBM in 1992… Dell in 1997… Microsoft in 1988… Cisco in 1992… Oracle in 1990… and Amazon in 2003… Google in 2005… to name just a few.

All told in his career he’s found 160 stocks that went up over 1,000%…

He’s been featured in:

- The Wall Street Journal…

- Barron’s…

- Bloomberg…

- Fox Business News…

- And CNBC…

And now in this brand new presentation Louis is revealing his next big prediction…

It’s a single piece of technology that’s going to disrupt markets worth $46 trillion…

Louis calls it “QaaS”…

And experts at consulting giant Mckinsey estimate “QaaS” technology will shake up everything from:

- Pharmaceuticals $1.5 trillion

- Oil & Gas $5 trillion

- Telecom $1.8 trillion

- Farming $5 trillion

- Aerospace $103 billion

- Logistics $10.4 trillion

- Automotive $2.8 trillion

- Finance $25 trillion

And before you start guessing… it has nothing to do with A.I. or ChatGPT…

Instead it’s a technology that’s going to be far more disruptive,

As Vice News reported,

“While advances in artificial intelligence have dominated headlines recently, [QAAS technology] could change our lives in ways that are even more far-reaching…”

And with this much potential —

“QaaS” technology is being backed by some of the biggest companies and investors in the world including Google, Amazon, IBM and Facebook…

And even Jeff Bezos.

And for investors who get in now — you’ll be capitalizing on the largest tech trend in history…

And Louis’s put together a full presentation to show you what to do.

About

In Growth Investor, we focus on today’s best mid- to large-cap stocks from a variety of sectors. The Buy List contains specific Buy Below prices and is always sorted into 3 categories of portfolio risk–Conservative, Moderately Aggressive or Aggressive–so you can buy according to your personal risk tolerance. Louis Navellier has been involved in the investing world for over 30 years. Since founding their research firm 45 years ago, their elite group has been responsible for accurately forecasting many of the world’s most innovative technological trends and breakthroughs long before they achieved mainstream acceptance.

© 2024 InvestorPlace Media, LLC. rights reserved.

We respect your Privacy and value your Feedback

1125 N. Charles St, Baltimore, MD 21201