Finally, life in America is returning to normal.

With more than half of Americans vaccinated, businesses are opening back up to full capacity. The U.S. economy is on the rebound.

But it isn’t all good news.

Many people are so caught up in post-2020 euphoria, that they’re in the dark when it comes to a huge economic event…

For well over a year, this has been buried underneath headlines about rising death tolls, social unrest, and political turmoil.

But now – thanks to rapid technology adoption over the past year – this event has accelerated.

And in just a handful of years, it could bankrupt millions of blue-collar workers.

Which is why Louis Navellier – a member of America’s one -percent – – is stepping forward with a dire warning, revealing exactly how everyday folks can protect themselves from the biggest financial shift in our lifetimes.

He’s made his fortune in money management, and today he is pulling back the curtain on a revolutionary shift currently underway in America… a shift that has nothing to do with government, our health care system, or a lack of socialist policies…

Billion-dollar money manager Louis Navellier claims this is going to usher in a new wave of companies poised to thrive over the next decade and beyond while others die off as part of a fading type of business model that could very soon become extinct.

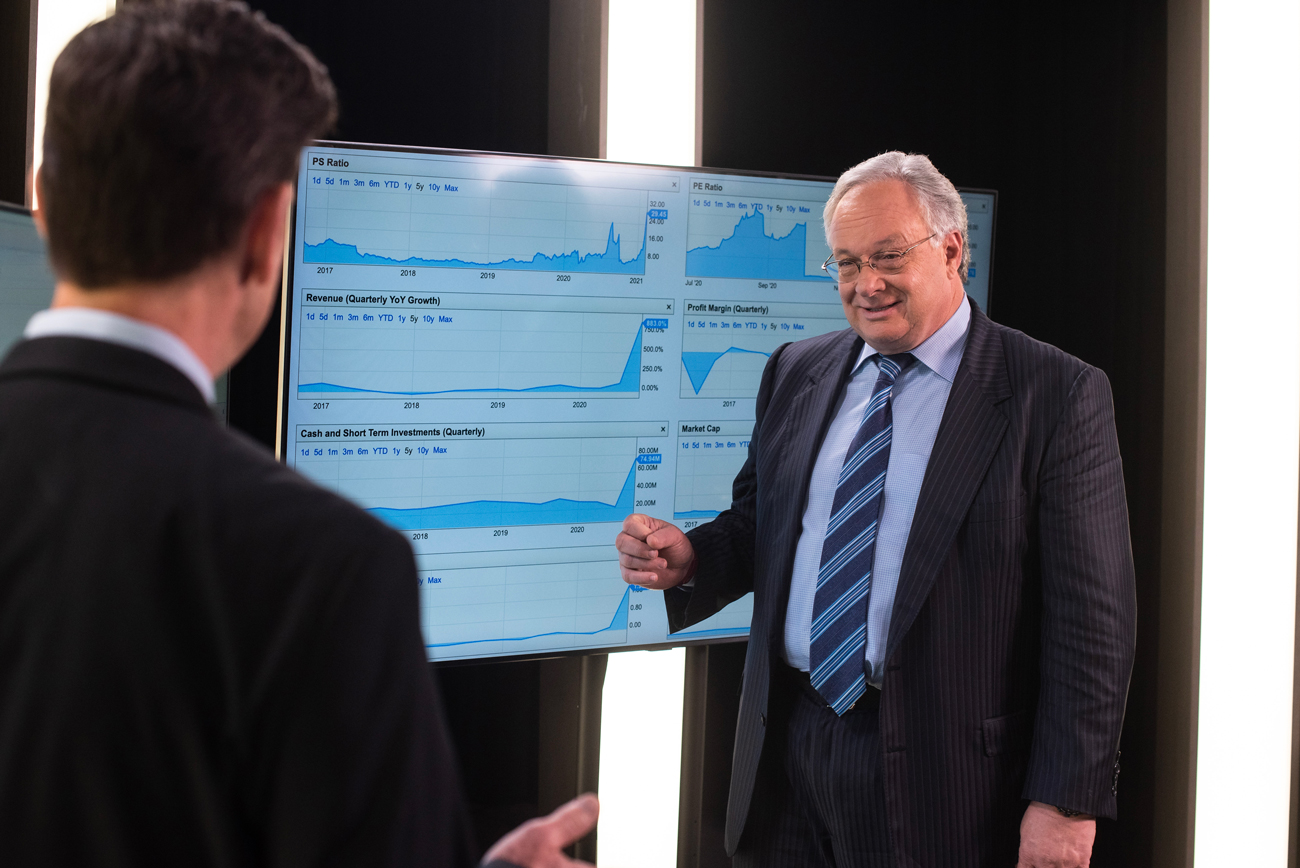

Louis has a knack for hitting the bull’s-eye with his timely market forecasts.

He has been called “one of the most important money managers of our time.”

And over a 15-year period, his investment fund turned every dollar invested into $41 — a 4,000% return that bested even Warren Buffett.

And now he’s issuing what he believes could be the biggest call of his career – highlighting companies set to thrive in our new society… companies that could allow investors to supercharge their retirement portfolios…

Watch his recently recorded, unedited video on his findings absolutely free of charge by clicking here now.

Keep in mind, the following information is considered highly controversial and has been shunned by the mainstream financial press. You will likely never see this anywhere else, so do not wait to view Mr. Navellier’s brief presentation before making another decision for you and your family.

Click Here to View His Presentation

About Growth Investor

In Growth Investor, we focus on today’s best mid- to large-cap stocks from a variety of sectors. The Buy List contains specific Buy Below prices and is always sorted into 3 categories of portfolio risk–Conservative, Moderately Aggressive or Aggressive–so you can buy according to your personal risk tolerance. Louis Navellier has been involved in the investing world for over 30 years. Since founding their research firm 45 years ago, their elite group has been responsible for accurately forecasting many of the world’s most innovative technological trends and breakthroughs long before they achieved mainstream acceptance.

*All investing includes risk of loss*